Public Insurance Adjuster Services

Mold Damage Insurance Claims

People at some point get their homes filled with mold damage. Typically, this is a condition that actually affects plenty of homes in the Miami area. Whether one lives in Miami, North Miami, Aventura, Ft. Lauderdale, or West Palm Beach, the fact is that as long as the house was exposed to water or moisture, your property has a high chance of developing mold and incurring damage. Of course, the unsightly effect the mold has is certainly something that one will not want.

The biggest health issue that one often faces with the mold damage is in the lungs. Molds are mildew growth found on damp areas. Allergies and flu like symptoms are often indications that the mold infestation inside the house is already quite complex and hard to remove. If left untreated, the mold presence could potentially endanger the life of the person as they encounter respiratory issues. Typically, the area of Miami is the most prone to hurricanes and storms. Thus, it is often normal that walls of houses, both inside and outside, will sustain mold growth.

Fire Damage Insurance Claims

When Fire Damage occurs at your home or business, life is abruptly turned around. Often, the toughest part is to understand how to begin and whom to contact. Most essential thing to keep in mind is the fact that possessions can get replaced, lives cannot. Fire Damage spreads speedily; there is absolutely no time for you to gather your property and assets as well as to call up your family and friends, In a matter of two minutes, fire can develop into a life threatening situation. Within 5 minutes, a property and the surrounding areas could be engulfed into flames.

In case your home is burning down – move out! Notify your Public Insurance Adjuster about the fire damage loss to your residence to get your Fire Damage Claim. Never dispose of any kind of damaged goods until an inventory is created. All damaged items are accounted for once we file the insurance claim for the Fire Damage sustained at your property. A Professional Fire restoration company is the best option to clean and restore your own personal possessions and home. However, remember to always take photographs and/or video clips of your current damaged property prior to having them restored as it will be a vital source in the recovery of a proper insurance claim settlement.

Roof Leak Damage Insurance Claim

Roof Leaks are one of the most frequent insurance claims that are filed in Florida, Miami, North Miami, Miami Beach and Broward areas. Filing most of these insurance claims can be extremely challenging for the property owner. Roof Leak Damage is usually grossly underrated by insurance companies mainly because of the nature of the water. The worst thing about water is that it has many after effects. In fact, not only should the policy cover for the expense of the repair of the house, it should also include the appliances and the furniture that has been damaged by the leaks.

Homes that sustained damage to the roof by severe rain and or storms can become extremely expensive. Our team is capable of supporting you immediately in recovering the proceeds from your insurance claim so that you may get started on the recovery.

Electrical Fire Damage Insurance Claim

Electrical fire damage often results from electric outlet fires caused by faulty electrical outlets and overloaded extension cords. Old, outdated appliances and wiring are also electrical fire hazards. Light fixtures, lamps and light bulbs are another common cause for electrical fire damage.

Most electrical fires happen almost-literally right under the homeowner’s nose. Faulty electronics, old appliances, and damaged wiring hidden in plain sight get too hot or spark suddenly and, without warning, an in-home fire is raging.

Just as careful preparation is required to prevent electrical fires in the home, the same amount of attention is required when actually filing a homeowner’s insurance claim after a fire breaks out.

Flood Damage Insurance Claim

Flood Damage is considered as something that nobody wants to have. It is a natural calamity that could potentially destroy all the belongings that one has, and it can even destroy the actual house that one lives in. A flood is usually fast rising water that is caused by the onset of too much rain or storm surges.

In Florida, Miami and Broward are more susceptible to Flood Damage compared to the other counties in Florida as they are located at the southern tip of the state. Plus, being a hurricane prone location, it is a place where most people will fear the presence of flood damages.

We have on staff the top professionals that will represent the insured with their insurance claim against their carriers. We are a team of Public Insurance Adjusters, Loss Estimators who will strive hard to obtain the maximum settlement for your property loss.

Cast Iron Pipe Insurance Claim

Cast Iron Pipes! Over the past several years, many older South Florida homes have experienced a failure of their cast iron plumbing wastewater pipes. This is becoming commonplace in older South Florida homes and affected homeowners need to be smart and alert in order to get through this most unfortunate situation.

If you’ve ever heard gurgling after a load of laundry or long shower, you might be hearing the early warning signs. Also, if a toilet seems to be flushing slower than it used to or needs multiple flushes, take note. As you might expect, as more homes are found with this issue, insurance companies are doing what they do best; denying and delaying current policyholder claims and quickly re-writing new policies to exclude coverage of this very problem. The longer you wait, the more likely you are not to get paid or get paid very little. Contact us so we can inspect and help you file your claim.

Plumbing Damage Insurance Claims

Have you suffered a water leak due to a faulty pipe in your laundry room. Yes it is a covered loss. Plumbing leaks are one of the most subtly dangerous disasters that can befall a household.

A small leak hidden somewhere in the walls can slowly undermine your home over the years and promote mold and mildew growth. A large, abrupt leak, on the other hand, can flood the home, destroy furniture and appliances, and make the place temporarily uninhabitable. Either one can cost thousands, or even tens of thousands, in repairs. In fact, water damage is among the most common reasons for homeowners’ insurance claims. Don’t let your house stay with all that water moisture which will create Mold.

Theft or Vandalism Insurance Claim

Have you experienced a Theft or Vandalism loss to your property? Do you need to file an insurance claim to cover the loss to your property due to the Theft damage or vandalism damage? Properties located in Miami-Dade, Broward or West Palm Beach, are at a high risk when compared to other counties in the state of Florida. Theft or Vandalism losses involve damages from destroyed doors, windows, graffiti, stolen items. A Theft or Vandalism loss would be considered the items taken from your home or business.

Our team of Public Insurance Adjusters will inspect and analyze every aspect of your Theft or Vandalism Insurance claim. We will come up with a thorough outline of the specifics for your possessions that were damaged or stolen and will ensure you are properly indemnified for your Vandalism or Theft Insurance claim.

Commercial Damages

Our licensed and experienced Public Adjusters have years of expertise in giving assistance to all kinds of insurance claims which include: vandalism/theft, water, fire, flood and hurricane damage. Call us for any property damage and we will guide you on how to properly mitigate the loss and proceed as per your insurance policy. Our experienced public adjuster will be at your home or business for evaluation of your loss within minutes in the event of an emergency. Our team of experts includes Public Adjusters, Attorneys, Contractors, Mediators and Engineers. We have gathered the best professionals to provide the top claim representation.

Get a Quote

We provide a Free Inspection!! No Recovery, No Fees. Contact us now for a free consultation. We serve the following areas: South Florida, Miami, Miami-Dade, North Miami, Miami beach, Miami gardens, Aventura, Doral, Kendall, Homestead, Key West, Broward, Weston, Ft. Lauderdale, Hollywood, West Palm Beach, Jupiter, Boynton Beach, Sunrise, Hallandale, Sunny Isle beach and the surrounding areas.

About Us

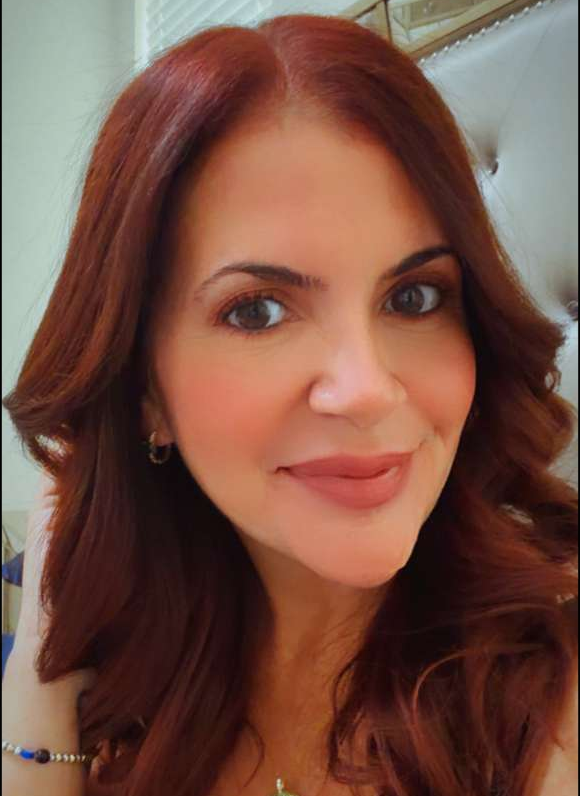

Hi my name is Saskia Cruz and I am a fully licensed Public Insurance Adjuster with experience in Residential and Commercial Property claims since 2003. This includes fire damaged homes, commercial apartment buildings, large home owners association townhomes, condos, commercial restaurants, and residential properties.

I became a licensed Public Insurance Adjuster working inside and outside. I handled over 2000 claims and supplements since 2003.

Appraiser and Umpire with 17 years of experience handling more than 2,000 claims up to $3+M in value with uncompromising personal and professional integrity and unbiased objectivity in all cases.

We are located in Miami Florida. We specialize in consulting property damage and value losses for residential and commercial property, appraisal representation and umpire services. We also perform expert testimony as needed. Our office enables us to serve the entire state. We currently appraise, consult, and umpire. It is our goal to bring closure to files timely. Performing investigations, problem resolution, and negotiate settlements. Preventing litigation when appropriate. I look forward to working with you.